Responsible Investment Policy: September 2023

1. Background

Development Partners International LLP (“DPI LLP”, “DPI” or the “Firm”) is a regulated financial institution, acting as an investment adviser, providing investment advice on private market transactions, principally pan-African private equity investments (“Portfolio Company “, Portfolio Companies”, “Investment” or “Investments”) through diversified collective investment schemes (the “ADP Funds” or “Funds”).

DPI believes that management of environmental, social and governance (“ESG”) issues are essential to the long-term success of these Portfolio Companies. Therefore, responsible investment (‘RI’) means growing sustainable businesses, whilst also delivering competitive returns and generating positive environmental and social outcomes. As a responsible investor DPI, through the Investments in the ADP Funds, is also committed to its core stewardship objective of active engagement and will use its influence over the Portfolio Companies to maximise long-term value.

2. Approach

The key tenets of RI have been a part of the DPI DNA since its inception, which was formalised by the partners of DPI with approval of the DPI Impact Management system (DPIMS) in February 2020. As such this policy has been developed, from those foundations, to ensure the responsible management of ESG matters at each of these Portfolio Companies. It seeks to set out DPI’s commitment to the integration and management of material ESG risks and opportunities across the Firm’s investment process, from origination to exit, as well as DPI’s approach to value creation.

DPI has a mission to drive positive, long-lasting social, environmental and economic impact across Africa. This is reflected in the ADP Fund’s intentionality to contribute towards the UN Sustainable Development Goals (“SDGs”) and create impact within the Portfolio Companies across gender equality, job growth and job quality, and climate change. DPI also seeks to identify additional impact themes specific to each Portfolio Company, such as financial inclusion, access to health products or food, and support in scaling the businesses to increase the reach of the company’s products and services.

Impact considerations, alongside ESG issues (together “IESG”), are firmly integrated into the DPI investment process. This allows the Firm to measure and monitor the IESG performance of Portfolio Companies against the ADP Fund impact objectives, as well as their contribution towards the SDGs.

The PRI (one of the pillars in DPIs reference framework – see below) defines stewardship as “the use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend. DPI, through the Investments it proposes to the ADP Funds, seeks to exert its influence by collaborating, as a shareholder, with the board of directors of each of the Portfolio Companies – through both active engagement and voting (for example, through voting rights and. board resolutions).

DPI is a member of the Global Impact Investing Network and a signatory of the Operating Principles for Impact Management, drawing on guidance from industry bodies, as set out below, in applying its impact framework.

3. Scope

This policy applies to each of the ADP Funds, with adoption across the firm by all DPI staff members.

DPI’s RI Policy is guided by its duty to ESG matters, and the approach has been developed from internationally recognised ESG principles and standards. These pillars form part of DPI’s Reference Framework surrounding ESG, and include but are not limited to:

- The International Finance Corporation (IFC) Performance Standards on Environmental and Social Sustainability (January 2012)

- The World Bank Group Environmental Health and Safety Guidelines (April 2007)

- UN Guiding Principles on Business and Human Rights (June 2011)

- ILO Declaration on Fundamental Principles and Rights at Work (June 2010)

- UN Principles for Responsible Investment (UNPRI)

- AfDB Environmental and Social Policies and Guidelines (2013-2015)

- The UN Sustainable Development Goals

- The 2X Challenge

These standards provide guiding principles in addressing environmental, social, governance, stewardship and human rights factors across investments in each of the Portfolio companies.

DPI has been developing these principles since inception, with each Investment reviewed on its own merits. As such these principles are applied on a case by case, where DPI believes it can add the most value at the time of investment, but often cannot be applied retrospectively. In specific cases, especially with separately managed accounts (“SMA”) DPI will apply the RI policy as deemed appropriate for each SMA.

4. Implementation

DPI has committed to providing sufficient resources for the effective implementation of responsible investment and the Firm’s ESG and Impact Management System (DPIMS). This includes providing DPI staff with knowledge, training and tools to enable them to identify and manage ESG matters across the ADP Funds. This includes having dedicated staff responsible and accountable for the day-to-day implementation of the policy as well as the use of external matter experts where appropriate. The overall responsibility of implementation of this policy also lies with the senior management of the Firm, with oversight from the CEO of the Firm.

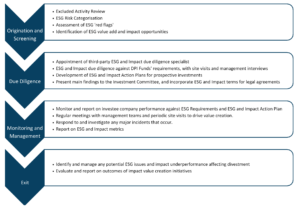

IESG,RI and stewardship are embedded across the firm’s investment cycle from screening and due diligence, through to monitoring and exit. This is illustrated by the DPIMS, as set out below:

DPIMS is reviewed on an annual basis to address industry developments, or any new material ESG matters which may arise from time to time. This is also verified every 2 years against the framework of the Operating Principles for Impact Management (“OPIMS”).

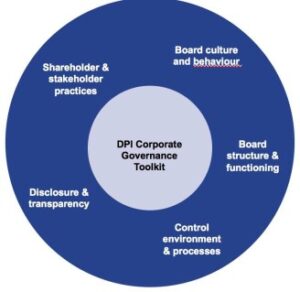

The Firm has also developed a governance toolkit to ensure that decision making at the boards at the Portfolio Company level are equipped to make decisions, with oversight from DPI, for a sustainable long-term outlook.

5. Responsibility

DPI has a dedicated team (“IESG Team”), that is responsible for both IESG and DPIMs. This is headed by the Head of ESG and Impact, who directly reports into the CEO of the Firm. The IESG team have the ultimate responsibility for overall management of ESG issues, including developing, implementing and supervising the DPIMS, as well as ensuring all RI and ESG matter are extended to all staff.

The Head of ESG and Impact is directly responsible for the integration of IESG matters across the investment process, as well as the application of the DPIMS. The IESG team includes ESG and Impact Analysts and associates, whose role it is to identify, assess and manage IESG risks and opportunities, including conducting operational level IESG due diligence, monitoring of each of the Portfolio Companies and reporting of ADP Fund IESG activities.

The Investment Committee of the Firm analyse IESG issues and opportunities as an integral part of the investment decision-making process.

Post-investment, the investment professionals, work with portfolio managers, and are responsible for deal assessment and on-going monitoring of Portfolio Companies. This includes formal governance board positions which ensure the progress against the IESG Action Plans.

6. Engagement

DPI supports the Portfolio Companies in addressing and mitigating ESG risks, whilst still maximizing the impact value creation opportunities, by ensuring compliance with international standards and best practice.

The Firm encourages Portfolio Companies to reduce ESG risks and their overall sustainability performance on a continuous basis through:

- The development of ESG and Impact Action Plans (“IESG Action Plan”). These are agreed by the relevant DPI investment team with the management of each Portfolio Company and then formalised in legal documentation. Each IESG Action Plan is based on the findings and baseline assessment of IESG metrics collected as part of the initial (pre-investment) due diligence process.

- Periodic monitoring of Portfolio Company compliance in line with DPI’s reference framework. The IESG team provide support in driving actions that align with best practice.

- Regular engagement with Portfolio Company management teams on progress against the IESG Action Plan, through periodic meetings and annual site visits.

- Inclusion of discussions of IESG-related issues at Portfolio Company Board meetings

7. Transparency and Collaboration

The Firm seeks to invest responsibly by ensuring transparency and communicating its process, goals and progress against clearly defined action actions plans with all relevant stakeholders, including investors, prospective portfolio companies, and industry organizations.

To support its commitment to the UNPRI and contribute towards improvements within the private equity industry, DPI engages with stakeholders on IESG matters by:

- Engaging employees, Portfolio Companies and other stakeholders regularly to clarify the approach to integrating IESG., along with and subsequent results.

- Participation in external collaboration with relevant industry bodies such as the UNPRI, the GIIN, Operating Principles for Impact Management, AVCA, ILPA and iCI.

- Management of any potential conflicts of interest between investors and the ADP Appropriate governance processes have been set up to reflect this commitment.

- The Firm does not engage in proxy

Further detailed engagement practices on stewardship are set out later in this policy document.

8. Reporting

The Firm reports on its responsible investment approach and activities through its Annual ESG Report to investors, highlighting ESG performance across the ADP Funds and underlying Portfolio Companies. In addition, ESG metrics surrounding employment and health and safety statistics are included within the Firm Portfolio Report which is issued to investors on a quarterly basis.

DPI also publishes an Impact report, on an annual basis, providing further information on its impact management and monitoring process as well as Portfolio Company-level results.

9. Policy Updates

This policy has been approved by the senior management of the Firm, the DPI Partnership and will be reviewed on an annual basis.

10. Guidelines

This Policy addresses key ESG factors and includes the following:

10.1 Exclusions

These exclusions apply to all DPI Investments; DPI will not invest in the following ‘Prohibited Activities’:

-

- Production or other activities involving forced labour or child labour;

- Production of or trade in any product or activity deemed illegal under applicable local or national laws or regulations or international conventions and agreements applicable in any relevant location;

- Activities, products or services related to prostitution;

- Trade in wildlife or production or trade in wildlife products regulated under the Convention on International Trade in Endangered Species (CITES) or Wild Fauna and Flora;

- Production or use of or trade in radioactive materials (other than the purchase of medical equipment, or quality control (measurement) equipment and any equipment where IFC considers the radioactive source to be trivial and/or adequately shielded);

- Production or use of or trade in unbounded asbestos fibres (this does not apply to purchase and use of bonded asbestos cement sheeting where the asbestos content is less than 20%);

- Cross-border trade in waste and waste products other than in compliance with the Basel Convention on the Control of Trans-boundary Movements and their Disposals;

- Unsustainable fishing methods such as blast fishing and drift net fishing in a marine environment using nets more than 2.5 km in length;

- Production of, use of or trade in pharmaceuticals, pesticides/herbicides, chemicals or wastes; ozone depleting substances; Polychlorinated biphenyls and other hazardous substances which are the subject of an international convention that provides for the phasing out or banning of their use;

- The (a) elimination or severe diminution of the integrity of a habitat caused by a major, long-term change in land or water use or (b) modification of a habitat in such a way that the habitat’s ability to maintain its role is lost;

- Commercial logging operations for use in primary tropical moist forest;

- Production of or trade in wood or other forestry products other than from sustainably managed forests;

- The production and distribution of racist, anti-democratic and/or neo-Nazi media;

- Production of, or trade in, arms (i.e., weapons, munitions or nuclear products);

- Production of or trade in (i) tobacco or tobacco related products; or (ii) alcoholic beverages (excluding beer and wine) *;

- Gambling, casinos or equivalent enterprises*.

- Activities, products or services related to pornography*.

- When investing in microfinance activities, production, trade, storage, or transport of significant volumes of hazardous chemicals, or commercial scale usage of hazardous chemicals. Hazardous chemicals include gasoline, kerosene, and other petroleum products.

- When investing in microfinance activities, production or activities that impinge on the lands owned, or claimed under adjudication, by Indigenous Peoples (as defined in Standard 7 of the Performance Standards), without full documented consent of such peoples.

* provided that (o), (p) or (q) shall not be Prohibited Activities if such activities contribute 10% or less of the annual turnover of the (Investee) Portfolio Company and its Associates or assets used for such activities represent 10% or less of the value of the assets of its balance sheet (on a consolidated basis where appropriate), or represents 10% or less of the financed volume (which means the activities being financed by the investment by the Partnership), or, in Financial Institutions, if financing of such activities account for 10% or less of the Institution’s portfolio volume (which means that, where an Investee Company is engaged in the business of lending, no more than 10% of the sums advanced are advanced to finance such activities);

10.2 Environmental Sustainability and Climate

DPI is committed to protecting the environment and minimising the effects of climate change through its activities. As part of this, the ADP Funds commit to:

- Integrate climate aspects into the investment process, assessing both potential physical and transitional climate risks and impacts of new investments on climate change;

- Implement climate impact reporting (e.g., GHG emissions Scope 1, 2 and 3 if possible) at both a Fund and Portfolio Company level and work with Portfolio Companies as appropriate to undertake efforts to reduce their impact on the effects of climate change;

- Integrate the objectives of the Paris Climate Agreement in the business strategy; and

- Integrate the recommendations of the Task Force on Climate-related Disclosures (TCFD) into the way in which the Fund operates, including measures to identify, assess and manage climate related risks across its investment portfolio.

In addition, DPI will work with Portfolio Companies where applicable to ensure each company implements and complies with environmental policies and guidelines that accord with the following key principles:

- Take account of the environmental impact of their operations (through a formal Environmental Impact Assessment (EIA) and take steps to mitigate any risks;

- Support efforts in reducing greenhouse gas emissions and enhancing resource efficiency as well as develop resilience to climate change risks;

- Promotion of an integrated approach to prevention and control of emissions into air, water and soil, to waste management, to energy efficiency and to accident prevention for the protection of the environment as a whole and therefore, avoiding the shift of pollution from one environmental medium to another

- Use an ecosystem approach to assess biodiversity-related risks and impacts, ensuring that the interdependencies between people, biodiversity and ecosystems are recognised.

- Seek opportunities to enhance biodiversity and ecosystems whenever possible in line with broader conservation efforts in the region or landscape where the project is located. Ensure that mitigation strategies align with regional-level conservation goals and do not solely address site-level impacts;

- Ensure transparent engagement with stakeholders regarding implications for biodiversity and ecosystems and appropriate participation of local communities in the decision-making process. This is especially important where impacts on biodiversity or ecosystem services could affect human rights or the livelihoods, wellbeing or culture of indigenous people.

10.3 Social Impact and Workplace Guidelines

DPI seeks to work with Portfolio Companies to ensure they implement and comply with the following workplace policies, principles and guidelines that accord with the key internationally accepted norms and standards on labour related issues:

- Pay wages which meet or exceed industry or legal national minima;

- Not engage in or benefit from any use of forced or compulsory labour and child labour;

- Not benefit from unfair, exploitative or abusive labour practices of suppliers or subcontractors;

- Respect and comply with the UN Declaration of Human Rights, International Bill of Human Rights, International Covenant on Civil and Political Rights and the International Covenant on Economic, Social and Cultural Rights;

- Adopt an open attitude towards workers’ organisations and respect the right of all workers to join or form workers’ organisations of their own choosing, to bargain collectively and to carry out their representative functions in the workplace1;

- Provide reasonable working conditions including a safe and healthy work environment, working hours that are not excessive and clearly documented terms of employment (2) and in situations where workers are employed in remote locations for extended periods of time, to ensure that such workers have access to adequate housing and basic services;

- Provide an appropriate grievance mechanism that is available to all workers and where appropriate other stakeholders (3).

- Provide adequate training to ensure workers can carry out their role in a safe manner and are provided with opportunity to further improve their skills.

- To treat their employees fairly and not discriminate in terms of recruitment, progression, terms and conditions of work and representation, based on personal characteristics unrelated to inherent job requirements, including gender, race, colour, caste, disability, political opinion, sexual orientation, age, religion, social or ethnic origin, marital status, membership of workers’ organisations, legal migrants or real or perceived HIV status (4);

10.4 Business Integrity and Good Corporate Governance

It is vital for a credible corporate culture of integrity to be underpinned by effective direction, processes, control and reporting. For this specific reason, DPI only makes Investments in entities that can exhibit honesty, integrity, fairness, diligence and respect in all business dealings.

DPI uses all reasonable best efforts to encourage Portfolio Companies to maintain sound corporate governance practices as are customary and commonly applied by entities organised under the laws of their respective jurisdictions of organisation.

Appropriate governance structures are implemented to provide adequate levels of oversight in the areas of audit, risk management, and potential conflicts of interest, and to implement compensation and other policies that align the interests of owners and management.

To this effect, DPI contractually requires that the Portfolio Companies in which it makes Investments will:

- Comply with all applicable laws, including those laws intended to prevent extortion, bribery, corruption, money-laundering and financial crime and adopt and implement policies and procedures to prevent extortion, bribery, corruption, money laundering and the financing of terrorism;

- Comply with relevant international sanctions, including those of the US, UK, European Union and the United Nations (“International Sanctions”);

- Uphold high standards of business integrity and honesty and deal with regulators in an open and co-operative manner;

- Prohibit all employees from making or receiving gifts of substance in the course of business; and prohibit the making of payments as improper inducement to confer preferential treatment;

- Prohibit contributions to political parties or political candidates, where these could constitute conflicts of interest;

- Properly record, report and review financial and tax information as required by relevant accounting standards;

- Promote transparency and accountability grounded in sound business ethics;

- Use information received from its partners only in the best interests of the business relationship and not for personal financial gain by any employee;

- Whistle-blowing – implement a procedure for the reporting of wrongdoing and misconduct in the workplace that includes protection for the reporter and appropriate disciplinary action for anyone found to harass the reporter;

- Clearly define responsibilities, procedures and controls with appropriate checks and balances in company management structures; and

- Use effective systems of internal control and risk management covering all significant issues, including environmental, social, ethical, and business integrity issues, including implementing a clear anti-bribery policy, the appointment of a senior officer to oversee, promote and report on its application and effectiveness, appropriate training for staff.

11. Stewardship: Active Engagement and voting rights

DPI engages with its Portfolio Companies to encourage proactive ESG disclosures, board and management diversity, and long-term sustainable business practices.

DPI advocates strong corporate governance structures that enhance transparency, accountability, and stakeholder inclusivity. The Firm also measures and reports on the impact of the Investments, considering social, environmental, and economic aspects on a periodic basis

Direct engagement is carried out with both the management teams and the boards of each of the Portfolio Companies at all stages of the investment process, through the life of the Investment and ultimate exit

- Origination and screening: During initial dialogue with management of the Portfolio Company teams, a clear understanding of the Investment’s potential contribution to key impact themes are sought, and a clearly defined scope for future engagement is agreed.

- Due diligence: Further engagement ensues to not only negotiate key aspects of the proposed transaction but to also define impact objectives and targets for the Investment. Expectations are clearly set for the management teams, and reinforced with buy-in to DPI’s management strategy and action plans.

- Post-investment monitoring: Periodic, organised meetings with management teams are arranged to discuss material impact and ESG topics, progress on agreed action plans, formalised impact data collection formalising the Investments impact risk and contribution, take place. The frequency of engagement will depend on the level of risk and timelines set for each action item, but for the first year of investment, DPI’s IESG team will engage with management teams on a monthly basis.

- Board oversight: DPI aims to hold board seats across all the Portfolio Companies. This will ensure that detailed analysis, and progress, on key impact themes are discussed at Board level, but also that DPI can continue to exert influence by voting on such fundamental matters.

DPI is an advocate of strong corporate governance structures that enhance transparency, accountability, and stakeholder inclusivity. As part of this goal, transparent reporting mechanisms are being established to provide stakeholders with meaningful information about ESG performance and progress toward impact goals. In addition, DPI has a well-developed tool-kit on corporate governance, as illustrated below, with Portfolio Companies, that enable the Firm to address many of the facets of good stewardship.

1 As defined by the ILO Freedom of Association and Protection of the Right to Organise Convention (No. 87) and the Right to Org anise and Collective Bargaining Convention (No. 98). See https://www.ilo.org/ilolex/english/docs/declworld.htm

2 Respecting any collective bargaining agreements that are in place or where these do not exist or do not address working conditions, make reference to conditions established, by collective agreement or otherwise, for work in the trade or industry concerned in the area / region where the work is carried out. and local or national law, IFC Performance Standard 2 and relevant ILO Conventions (https://www.ilo.org/dyn/travail/travmain.home). For working hours, see also, the ILO Hours of Work (Industry) Convention (No.1) (see https://www.ilo.org/global/standards/subjects-covered-by-international-labour-standards/workingtime/%20lang–en/index.htm)

3 See IFC Performance Standard 2 and the “Effectiveness Criteria for Non-Judicial Grievance Mechanisms” within the UN Guiding Principles on Business

and Human Rights (GuidingPrinciplesBusinessHR_EN.pdf (ohchr.org) for guidance.

4As covered by the ILO Equal Remuneration Convention (No. 100) and the ILO Discrimination (Employment and Occupation) Convention ( No. 111), allowance could be made where positive discrimination is mandated in law and is intended to address a historical imbalance. See https://www.ilo.org/ilolex/english/docs/declworld.htm